Writing the Bir Form 1901 form is simple with this PDF editor. Stick to these steps to prepare the document right away.

Step 1: The webpage includes an orange button saying "Get Form Now". Click it.

Step 2: At this point, it is possible to change the Bir Form 1901. Our multifunctional toolbar helps you include, get rid of, transform, highlight, as well as undertake similar commands to the content material and areas inside the file.

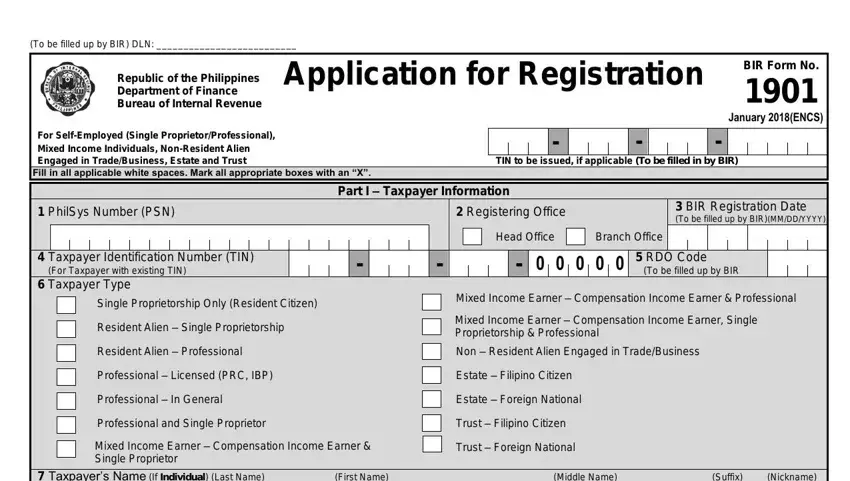

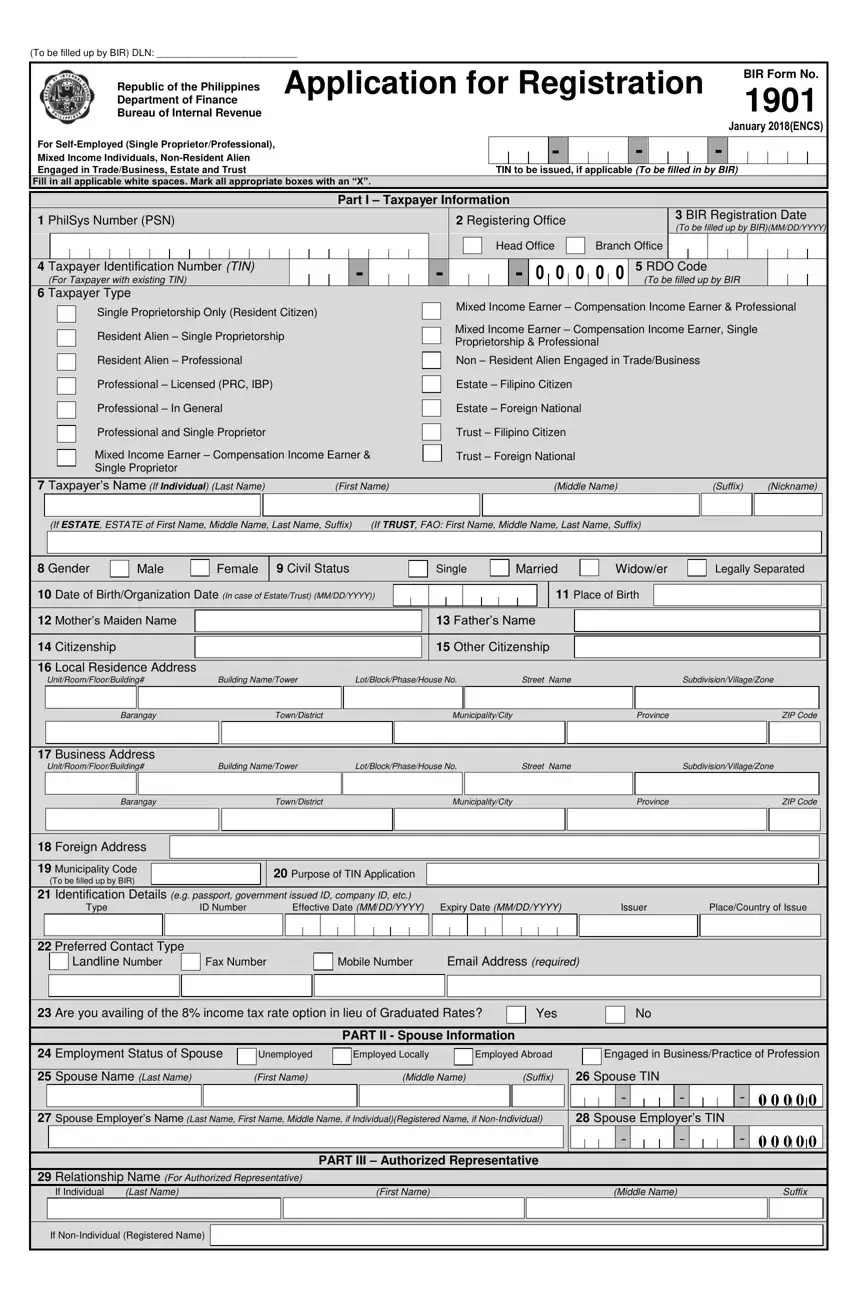

Fill in the Bir Form 1901 PDF by entering the data meant for each part.

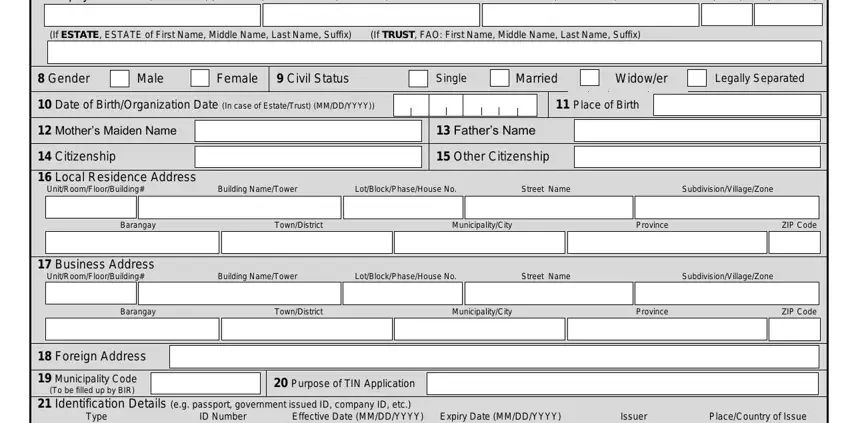

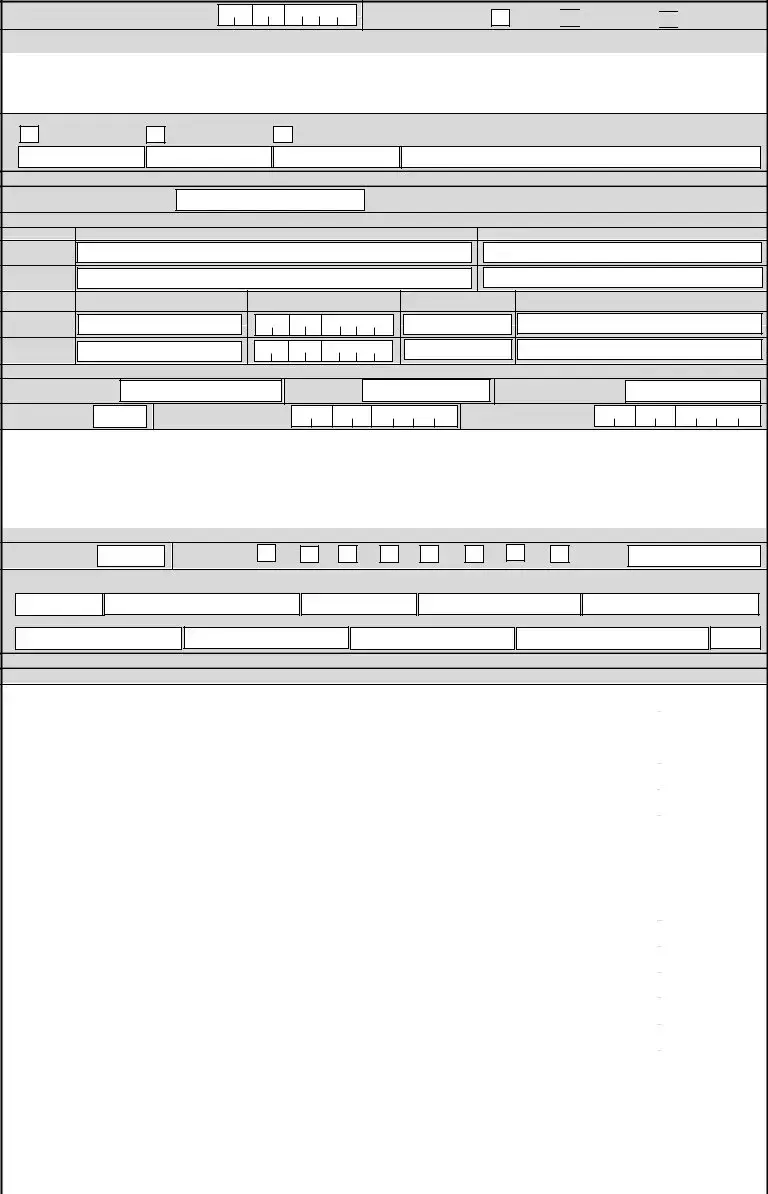

Remember to fill in the Taxpayers Name If Individual Last, If ESTATE ESTATE of First Name, Gender, Male, Female, Civil Status, Single, Married, Widower, Legally Separated, Date of BirthOrganization Date In, Place of Birth, Mothers Maiden Name, Citizenship, and Fathers Name box with the requested data.

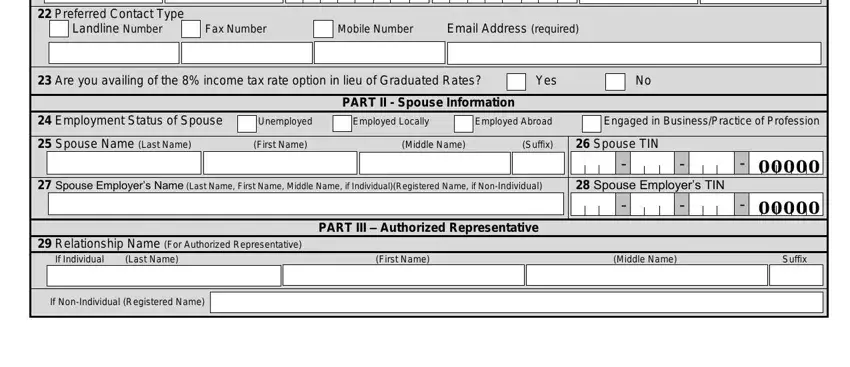

You may be asked to write down the information to let the system complete the segment Preferred Contact Type Landline, Are you availing of the income, Yes, PART II Spouse Information, Spouse Name Last Name First Name, C i v i l, C i v i l, C i v i l, Spouse Employers Name Last Name, Spouse Employers TIN, Spouse TIN, C i v i l, Relationship Name For Authorized, PART III Authorized Representative, and If Individual Last Name First Name.

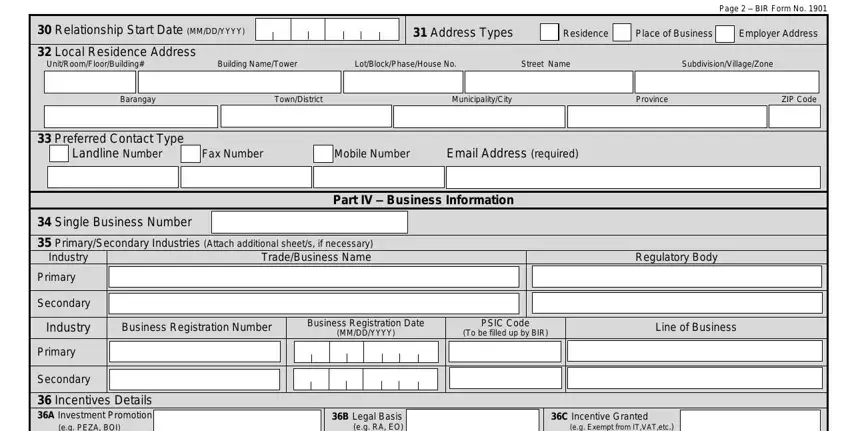

The Relationship Start Date MMDDYYYY, Address Types Residence Place of, Local Residence Address, Building NameTower, Page BIR Form No, Barangay TownDistrict, Preferred Contact Type Landline, Part IV Business Information, Single Business Number, PrimarySecondary Industries, Industry, Primary, Secondary, Regulatory Body, and Industry area is where either side can put their rights and responsibilities.

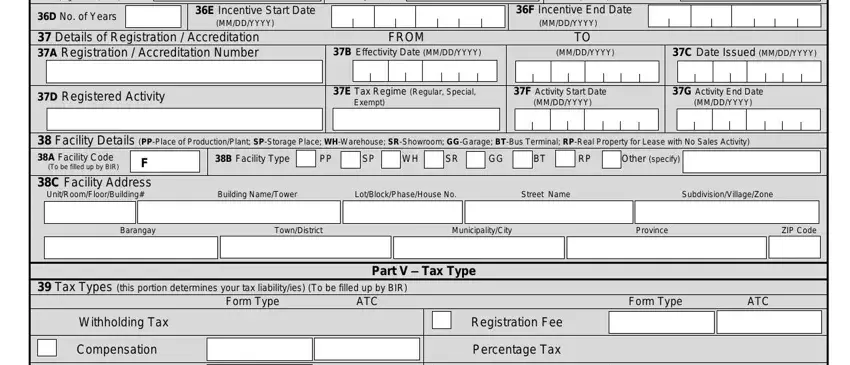

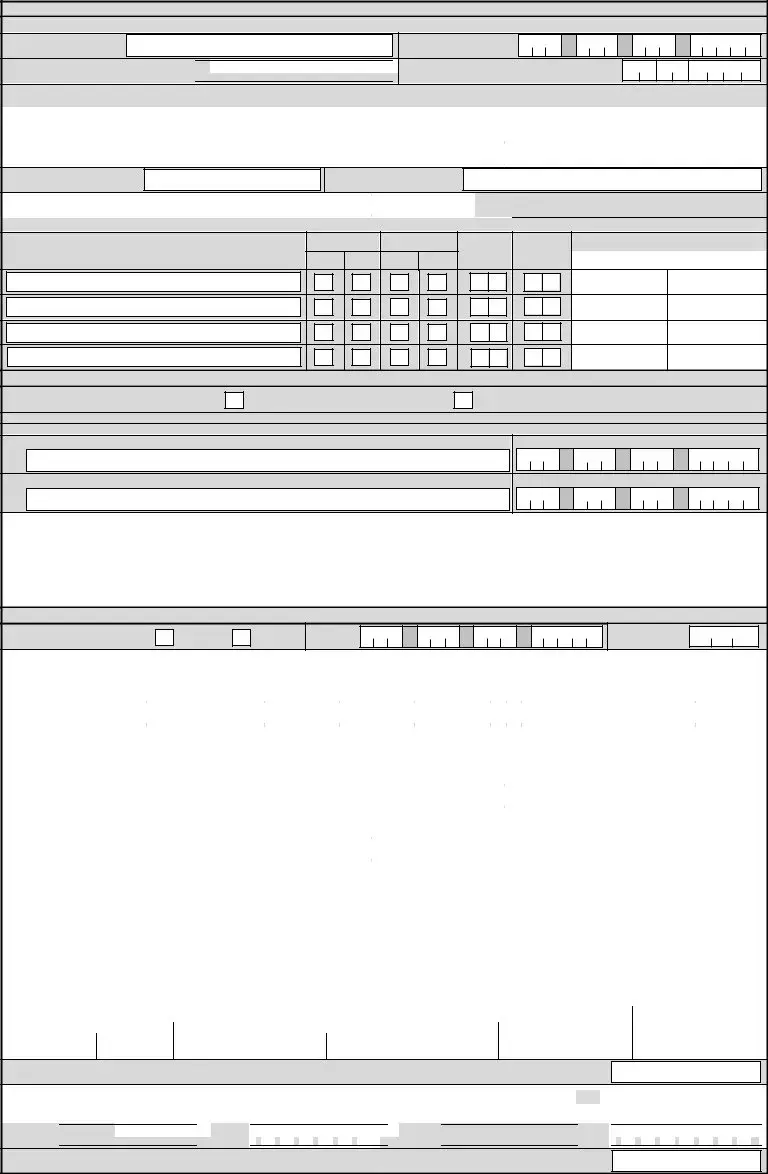

Fill in the document by checking the next sections: Incentives Details A Investment, D No of Years, B Legal Basis eg RA EO, E Incentive Start Date MMDDYYYY, C Incentive Granted eg Exempt from, F Incentive End Date MMDDYYYY, Details of Registration, B Effectivity Date MMDDYYYY, MMDDYYYY, C Date Issued MMDDYYYY, D Registered Activity, E Tax Regime Regular Special Exempt, F Activity Start Date MMDDYYYY, G Activity End Date MMDDYYYY, and Facility Details PPPlace of.

Step 3: Hit the "Done" button. Next, it is possible to transfer the PDF file - download it to your electronic device or send it by using email.

Step 4: You should make as many copies of your document as possible to avoid possible misunderstandings.

Engaged in Business/Practice of Profession

Engaged in Business/Practice of Profession

-

-  -

-

-

-

Place of Business

Place of Business

Employer Address

Employer Address

60B

60B

60C

60C